Any financing department will likely deal with purchase orders every day. But what’s actually a purchase order and just how does it differ from a invoice?

Most people imagine we understand a real difference between an invoice and a purchase order but if we were asked to explain it, would you really know with full confidence what they have in common and what sets it apart?

What is considered to be a purchase order? A purchase order is considered to be the official evidence of an order. It is normally by means of the documentation forwarded from the purchaser to a establishment authorising a certain purchase. An invoice, however, is seen as a request for money from your seller to a purchaser. Also there are usually several essential variances between the 2.

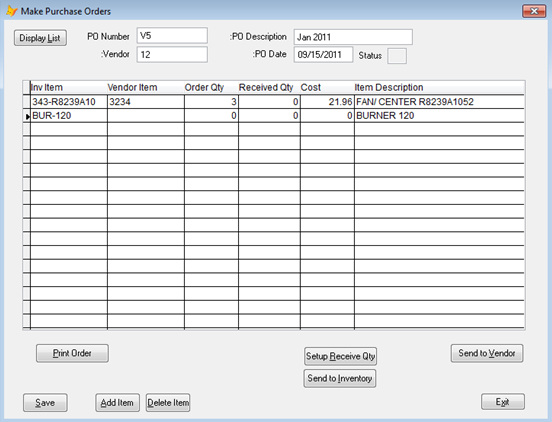

A purchase order is made up info just like the date the purchase was made and also the business name of a company acquiring the goods or services. There’s a summary and a record of the amount of the merchandise or simply professional services, the purchase price and then agreed payment details. You will also find the billing address, purchase order figure, delivery location and infrequently the anticipated arrival time. An invoice consists of the exact same info as purchase order, plus an invoice number, vendor contact information, credit and even discounted rates and also a cost time frame. It will include the amount due to seller.

So, just how are they comparable? You’ll find a couple of important parallels. Each invoices and purchase orders are generally legally binding commitments. An official understanding has been made with both parties and it is specified in the contents of the documentation. They will also each contain a lots of the same specifics, as stated before.

Why Use A Purchase Order System

So why utilize a purchase order instead of an invoice? There are plenty of important logic behind why organizations like to use POs. One of those is they set apparent visions and enable the individual to convey their needs to suppliers. And if there is any imbalances concerning products or service given, then all parties can use the particular PO as a legitimate reference.

POs also aid to handle transactions, producing professional documentation of incoming and even pending shipments. This lets organisations track and additionally organize orders more proficiently. POs can also help with budgeting, encouraging businesses to factor expenses in to company budget and sustain a closer observation on expenditure.

Because they’re officially binding, they are used even without a proper contract. However, this is just true following your P . o . is approved by the vendor. POs also make a vital part of book keeping trails, along with POs providing you with what you may need keep auditors at bay.

Purchase orders are mostly put into use each time a consumer wants to buy materials and / or inventory on account. They supply quick visibility of inbound products so you, as a buyer, are able to see how much will be coming and when is it is going to turn up. Any well-managed purchase order software will show you what’s been purchased, shipped and received, but not what has been invoiced. You may also see what goods and services have been shipped compared to precisely what you initially ordered, that can help to eliminate errors. On the internet invoicing software makes it much easier to send out purchase orders, with pre-designed templates and automated reminders making it possible to manage your POs in a more streamlined way.

You will discover 1,000’s of web sites with information involving ‘po software’ this really is one of the better websites cloudb2b.co.uk/

So why use invoices? Invoices equip vendors to receive the actual cash they’re due. As most vendors don’t receive revenue for services or goods till afterward their unique invoice is dispatched, this will make it the best way to ensure that reimbursement is generated on schedule.

Invoices provide insight into organization spending, explaining just what exactly you’re purchasing for the money. This also permits greater openness into what various areas of the business are buying. If you ever need assistance to keep control transactions, then invoices reveal in a professional way what has been sold, how much and if there is any outstanding charges.

Invoices can be a useful method of following cash flow and running costs. They let you to view the sale of merchandise for better stock management and also to figure out profit. When utilised well, invoices work as documents for all transactions. In addition, invoice reports show which orders placed are actually completed and also paid for and those that are outstanding and from which clients you might be owed money. Invoices award you with detailed monetary control of your company. And with invoice management applications, you can stay up to date with your invoicing and consumer payments at all times.

And The Winner Is…

Invoices and purchase orders can easily both be an important part of a company’s buying model. It’s for this reason important to recognize how both invoices and purchase orders operate, what they’re useful for, the way they are different and in what way they may be comparable. Of course, the key difference you always need to bear in mind is the fact a purchase order delivered from a purchaser to a vender to place an order, whilst an invoice is delivered from the vendor to a customer to request payment for an order.

So, either invoices and POs are a major factor of a successful company. It’s smart to be familiar with the way they work, what they are utilized for and what they’re able to offer your business.